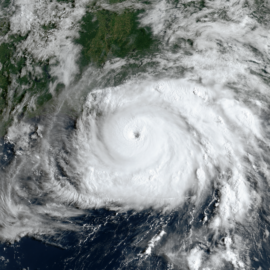

This is a cautionary take of what we might expect to happen throughout the state but especially in South Louisiana.

Ascension Parish government is seeing a 50% increase in its property insurance rates for the new year even after it resorted to buying a third as much coverage and tapping multiple insurers to spread out risk, the parish’s agent says. The parish government, which avoided the hardest hit from Hurricane Ida last year, may feel the leading effects on government insurance rates after another threatening and destructive hurricane season hit south Louisiana. “In my 29 years of being in business, the current market conditions for property insurance are the worst that I’ve ever seen,” Bret Hughes, agent for Ascension government, said in a text message this past week.

theadvocate.com

There will be some pain to a lot of pain throughout the southern end of the state.

In Livingston and Tangipahoa parishes, where Ida’s powerful winds had more bite even miles inland from the coast, some local governments say they are preparing for the worst or are already seeing it filter into new annual insurance premiums too. Unlike Ascension government, Tangipahoa Parish government has individual policies for each of its buildings. Increases so far on about half of the buildings have ranged from 3% to 114% as policies have come up for renewal, according to a parish breakdown. The policy on the parish Health Unit in Amite, which took a tree through the roof during Ida, more than doubled, boosting parish expenses on that one building’s policy by nearly $7,000. Jeff McKneely, director of finance for Tangipahoa government, said the Health Unit’s premium had been on track to quadruple. The parish insurance agent was able to shop it around and reduce it to a 114% increase over the previous year’s premium.

What the parish is experiencing is also being found in the cities and towns in the parish.

The parish governments’ experience is no different than that of many cities and towns this year, according to John Gallagher, executive director of the Louisiana Municipal Association. They are also reporting similar experiences with their insurers after Hurricane Ida slammed the Louisiana coast on Aug. 29, following a run of other destructive hurricanes over the past two to three years. LMA member communities across the state are telling the association, which has its own third-party risk management pool for other kinds of insurance needs, that property insurance costs are going up and many insurers are getting out of the municipal property market because of Ida and past storms. “We’re looking at possibly getting involved,” Gallagher said, “and providing the coverage since regular insurance companies are getting out.”

Ida was an expensive storm and one that cost insurers a lot.

Hurricane Ida caused $36 billion in insured losses, the second most for any hurricane in U.S. history, according to the Insurance Information Institute, an insurance industry trade group. Early modeling estimates put Louisiana’s loses at $18 billion, according to the firm Karen Clark and Co., but later estimates push the number closer to $20 billion. The Category 4 storm, which killed 26 people, is one of 19 named storms that made landfall in the U.S. in 2020 and 2021 and was part of a hurricane season that had 21 named storms, third most in history, the National Weather Service says. The storm’s potent winds — sustained for a time at 150 mph — knocked out power for 1.2 million ratepayers in the state.

These cost estimates are coming as the US says it is only going to get worse.

The string of storms also comes as a key United Nations panel continues to issue increasingly dire warnings about the impact global climate change will have on sea level rise and the state’s already eroding coastline as hurricanes are also ratcheted up in frequency and intensity. Ida hit the private homeowner market hard, as tens of thousands of homes were damaged by high winds and flood water. Inflation and high labor and materials costs have strained insurers resources, state insurance regulators have said, and three regional insurers have been placed in receivership by the state due to their financial problems. Louisiana Citizens Property Insurance, the state’s insurer of last resort, was projected late last year to have nearly half billion dollars in losses. But, data from the state Department of Insurance suggests homeowner rates hadn’t gone up too much, about 6.7%, on average, at the end of 2021. Department of Insurance officials said they have received calls from homeowners about large premium increases, but most have been due to significant increases in the value of the property insured.

Another problem is finding an insurer to take on the risk in southern Louisiana.

One of the problems some agents for governments are identifying is finding insurers willing to take on a lot of risk in south Louisiana. Hughes, the Ascension Parish government insurance agent, told the Parish Council earlier this month that he couldn’t find one insurer to provide all of the $153 million in property coverage that the parish had last year, despite reaching out to more than 40 companies. A leading broker for other local governments, U.S. Risk, is being told the same thing that he was told by insurers, Hughes added. “We were literally told by every market we went to, ‘You cannot get $153 million in coverage this year for Ascension Parish. It is not possible. You need to figure out, Bret, what’s your worst-case scenario and insure that,'” said Hughes, owner of Hughes Insurance Services in Gonzales.

Innovative ways are being used to try to get insurance.

Hughes asked insurers and others to model that worst-case level of risk — about $50 million in losses in one event — and then he spread the risk over 11 different insurers, or what is called insurance “layers.” Chuck LeBlanc, the Ascension Parish School Board’s insurance agent, said he too is seeing this “capacity” problem. He asserted that continued reports about the impact climate change may have on Louisiana is making reinsurers, like Lloyd’s of London, which back up insurance companies, skittish even if they are only being asked to take a share of the risk. “And it used to be easy. We could fill (the insurance layers) up right quick, but everybody’s kind of, you know … It goes back to capacity,” said LeBlanc, an agent and part owner of Bourg Insurance Agency in Ascension. Ascension Parish schools, for instance, have about $740 million in property, dwarfing the value in parish government, which owns courthouses, the parish jail and other public buildings. LeBlanc said he is still trying keep increases for the school system at 20% to 25% but may have to cut insured values to do it.

Other parishes are finding the same.

Wendy Gill, risk manager for Livingston Parish schools, said that parish system saw a small increase in October to insure its 45 school sites worth a combined $347 million. Gill, however, said the system has been told by its agent to expect a bigger increase next October once the full impact of Ida is felt, perhaps in the range of 20% to 30%. “They gave us a warning that it’s coming,” she said.

These increaes will hit is both in our home insurance and in the taxes we pay.